Vibe Trading: The Math Behind the 50%+1 Rule

Introduction to Vibe Trading

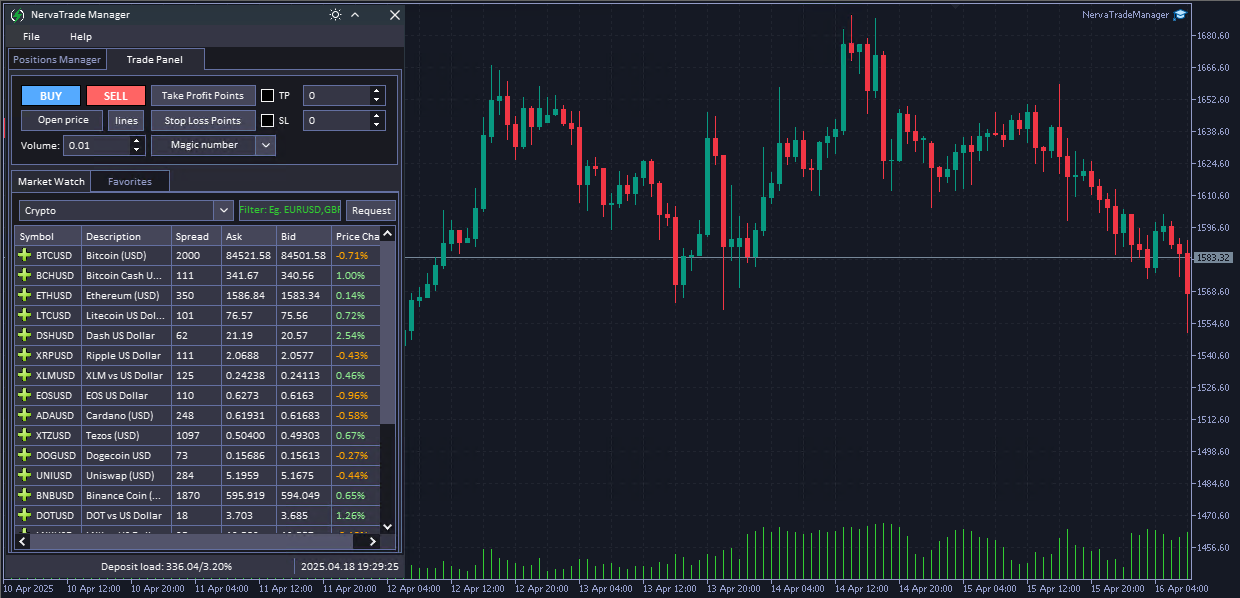

Vibe Trading represents a paradigm shift in algorithmic trading. Instead of coding complex strategies through hundreds of lines of MQL5, traders simply express their trading ideas in natural language—what we call a "prompt"—and let the N.E.R.V.A. (Neural Enhanced Real-time Vision Analytics) API interpret and execute those ideas.

But beyond the convenience of natural language interfaces lies a powerful mathematical principle: combining multiple independent strategies with positive edge dramatically increases your probability of profit. This is the foundation of what we call the "50%+1 Rule."

The 50%+1 Rule: Probability Theory

"If every strategy has probability p of ending green each day and they are roughly independent, the chance that at least 50% + 1 of n strategies are winners is calculated using the binomial distribution."

This principle is not a proprietary invention but a direct application of the binomial distribution, first formalized by Jakob Bernoulli in the early 18th century. In modern finance, it has been adapted and applied by quantitative traders like Edward Thorp and funds like Renaissance Technologies' Medallion Fund.

The key insight is this: while individual trading strategies might have modest win rates (e.g., 55%), combining multiple uncorrelated strategies dramatically increases the probability that at least half of them will be profitable on any given day.

Mathematical Breakdown

The formula that captures this phenomenon is:

$$P(\text{profit}) = \sum_{k=\lceil n/2 \rceil+1}^{n} \binom{n}{k} p^k (1-p)^{n-k}$$

Where:

- $P(\text{profit})$ is the probability that the portfolio is profitable

- $n$ is the number of independent strategies

- $p$ is the probability of each strategy being profitable -assuming all strategies have the same probability for simplicity-

- $\binom{n}{k}$ is the binomial coefficient, representing the number of ways to choose $k$ winning strategies from $n$ total strategies

- $\lceil n/2 \rceil+1$ is the ceiling of $n/2$ plus 1, representing the minimum number of strategies that need to be profitable for the majority to be profitable

This formula calculates the sum of probabilities for all scenarios where more than half of the strategies are profitable.

A Practical Example

Let's consider a concrete example:

- We have 13 independent trading strategies

- Each strategy has a 55% probability of being profitable on any given day

- We want to calculate the probability that at least 7 strategies (majority) will be profitable

Plugging into our formula:

$$P(\text{profit}) = \sum_{k=7}^{13} \binom{13}{k} (0.55)^k (0.45)^{13-k}$$

Calculating this sum:

$$P(\text{profit}) = \binom{13}{7}(0.55)^7(0.45)^6 + \binom{13}{8}(0.55)^8(0.45)^5 + ... + \binom{13}{13}(0.55)^{13}(0.45)^0$$

$$P(\text{profit}) \approx 0.90 \text{ or } 90\%$$

This means that with just 13 independent strategies, each with a modest 55% win rate, the probability that more than half of them will be profitable on any given day is about 90%.

Key Insight:

As you increase the number of independent strategies (n), the probability of the majority being profitable approaches 100% if each strategy has p > 0.5.

Practical Application in Trading

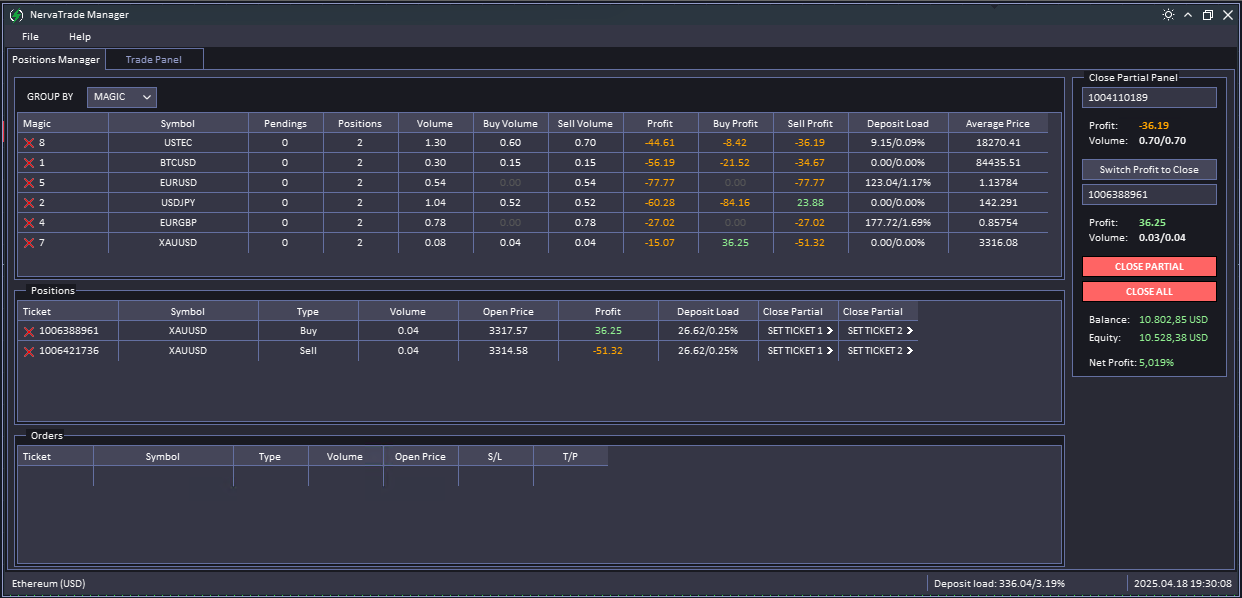

In the context of Vibe Trading with NervaTrade, this mathematical principle is particularly powerful because:

- Creating multiple strategies is simple - With prompt-based trading, you can quickly author dozens of strategy variations without extensive coding.

- Diversification is natural - Different prompts can target different market conditions, instruments, and timeframes, helping ensure independence.

- Risk management is integrated - By allocating only a small percentage (R%) of equity to each strategy, the maximum portfolio drawdown is limited to n × R%.

What makes this approach so powerful is the reduction in variance. The relative variance of the combined strategy is:

$$\operatorname{Var}\left(\frac{K}{n}\right) = \frac{p(1-p)}{n}$$

This means that as you increase the number of strategies (n), the volatility of your returns decreases proportionally to $1/n$. The result is a much smoother equity curve over time.

Implementation Steps

To implement the 50%+1 approach with Vibe Trading:

| Step | Description | Purpose |

|---|---|---|

| 1. Edge Estimation | Measure win rate, average payoff, Sharpe ratio, out-of-sample robustness for each strategy | Ensure p > 0.5 with reasonable confidence |

| 2. Independence Verification | Calculate correlation matrix of daily returns between strategies; discard or downsize highly correlated ones | Binomial formula only valid if outcomes aren't clustered |

| 3. Strategy Count Selection | Use binomial formula to determine how many systems you need for e.g., ≥ 90% probability of closing green | Increasing n rapidly raises P(profit) when p > 0.5 |

| 4. Capital Allocation | Distribute at most R% of equity to each strategy (e.g., equal weight or risk parity); ensure Σ Rᵢ ≤ 100% | If all strategies lose together, maximum drawdown is ≤ n×R |

| 5. Position Sizing | Within each strategy, use fractional Kelly - ½-Kelly is common - to maximize log growth while limiting volatility | Kelly derives from same probabilistic framework and integrates well with the "many edges" logic |

| 6. Dynamic Monitoring | Recalculate p̂ and correlations on rolling windows; suspend or reduce if edge decays (< 50%) | Markets change, probabilities aren't static |

Quick Numerical Example

- Average edge per strategy: p = 0.55 (55% of green days)

- Target: at least 90% probability that the portfolio closes green

Using a spreadsheet or small script, you can find that just 13 independent strategies are sufficient: with n=13, the upper tail of the binomial exceeds 90%.

Example XML Strategy

Here's an example of a single XML strategy that could be one of your n strategies in the Vibe Trading approach:

<strategy>

<general_instructions>

• Time-frame: M5 execution, M15-H1 context

• EMAs: 5 / 10 / 60 / 223

• Chart-cleanliness rule → output "NEUTRAL" if tangled ≥5× in 12 candles

• AI returns LONG / SHORT / NEUTRAL on each new M5 candle

</general_instructions>

<buy_conditions>

1. Market structure → bullish BOS / CHoCH on M5

2. EMA alignment → EMA-5 > 10 > 60 > 223 **or** sweep below 223

3. Order block → re-entry into demand OB with volume spike

4. Liquidity sweep → stop-run below low + reversal engulfing/pin-bar

5. Fair-Value Gap → unfilled bullish FVG

</buy_conditions>

<sell_conditions>

1. Market structure → bearish BOS / CHoCH on M5

2. EMA alignment → EMA-5 < 10 < 60 < 223 **or** sweep above 223

3. Order block → re-entry into supply OB with volume spike

4. Liquidity sweep → stop-run above high + reversal

5. Fair-Value Gap → unfilled bearish FVG

</sell_conditions>

<neutral_conditions>

• "Dirty" chart (EMA rule)

• Low volatility (ATR20 < ATR50)

• Conflicting bias between M15/H1 and M5

• Lack of valid OB / FVG / sweep

</neutral_conditions>

<data_sources>

@{@SYMBOL,OHLC[M5,500]}

@{@SYMBOL,OHLC[M15,300]}

@{@SYMBOL,OHLC[H1,200]}

@SCREENSHOT[@SYMBOL,M5,TEMPLATE(SMC_4_1.tpl)]

@SCREENSHOT[@SYMBOL,M15,TEMPLATE(SMC_4_1.tpl)]

@SCREENSHOT[@SYMBOL,H1,TEMPLATE(SMC_4_1.tpl)]

</data_sources>

</strategy>To leverage the 50%+1 principle, you'd create multiple variations of such strategies, each with a slightly different approach but still maintaining a positive edge.

Caveats and Considerations

1. Fictitious Independence

Strategies based on the same signal - e.g., EURUSD breakout at 5m and 15m - often collapse into a single large bet: the formula breaks down.

2. Unstable Edges

A "clean" backtest doesn't guarantee that p stays > 0.5 in the future; implement automatic derating mechanisms.

3. Transaction Costs and Slippage

These reduce the effective edge; calculate p net of costs.

4. Leverage

More strategies often means more margin; the R% fractionation must be chosen with leverage requirements in mind as well.

Conclusion

The "50%+1 Rule" is not an esoteric secret but an application of a classic probability theorem. In systematic trading, it becomes an operational framework: accumulate many independent micro-edges, manage the size of each, and the portfolio will (almost) always be positive—with controlled drawdowns.

Vibe Trading with NervaTrade makes this approach more accessible than ever before, allowing traders to rapidly create, test, and deploy multiple independent strategies through simple, natural language prompts instead of complex code.

Final Thought:

"The 50%+1 approach doesn't guarantee instant riches—it's about converting volatile, unpredictable returns into a smoother, more reliable growth trajectory through the fundamental laws of probability."

Ready to Try Vibe Trading?

Start creating your own set of independent trading strategies using N.E.R.V.A. API and the power of natural language prompts.