Smart Money Concepts with NervaTrade AI: Institutional Order Flow

Introduction to Smart Money Concepts

Smart Money Concept (SMC) trading has gained immense popularity among sophisticated traders for its ability to identify and capitalize on institutional order flow. However, properly implementing SMC strategies has traditionally required extensive market knowledge, screen time, and the ability to interpret complex chart patterns.

NervaTrade's AI-powered approach changes this paradigm completely. By leveraging our Neural Enhanced Real-time Vision Analytics (N.E.R.V.A.) API, traders can now automate the identification of key SMC patterns—like order blocks, fair value gaps, and liquidity sweeps—without needing to code complex algorithms or spend hours analyzing charts.

What is Smart Money Concept Trading?

"Smart Money Concept trading is a methodology focused on identifying and trading with institutional order flow, rather than against it. It's about understanding how banks, hedge funds, and other large players move the market—and then positioning yourself accordingly."

SMC trading differs from traditional technical analysis in several key ways:

- It focuses on order flow rather than indicators

- It prioritizes market structure over patterns

- It identifies institutional footprints rather than retail trader sentiment

- It emphasizes supply and demand imbalances that create trading opportunities

The core premise is simple yet powerful: large institutional traders leave consistent, identifiable footprints on the chart. By learning to recognize these footprints, retail traders can align themselves with the "smart money" rather than fighting against it.

Key Components of SMC

Smart Money Concept trading revolves around several key components, which NervaTrade's AI system is specifically trained to identify:

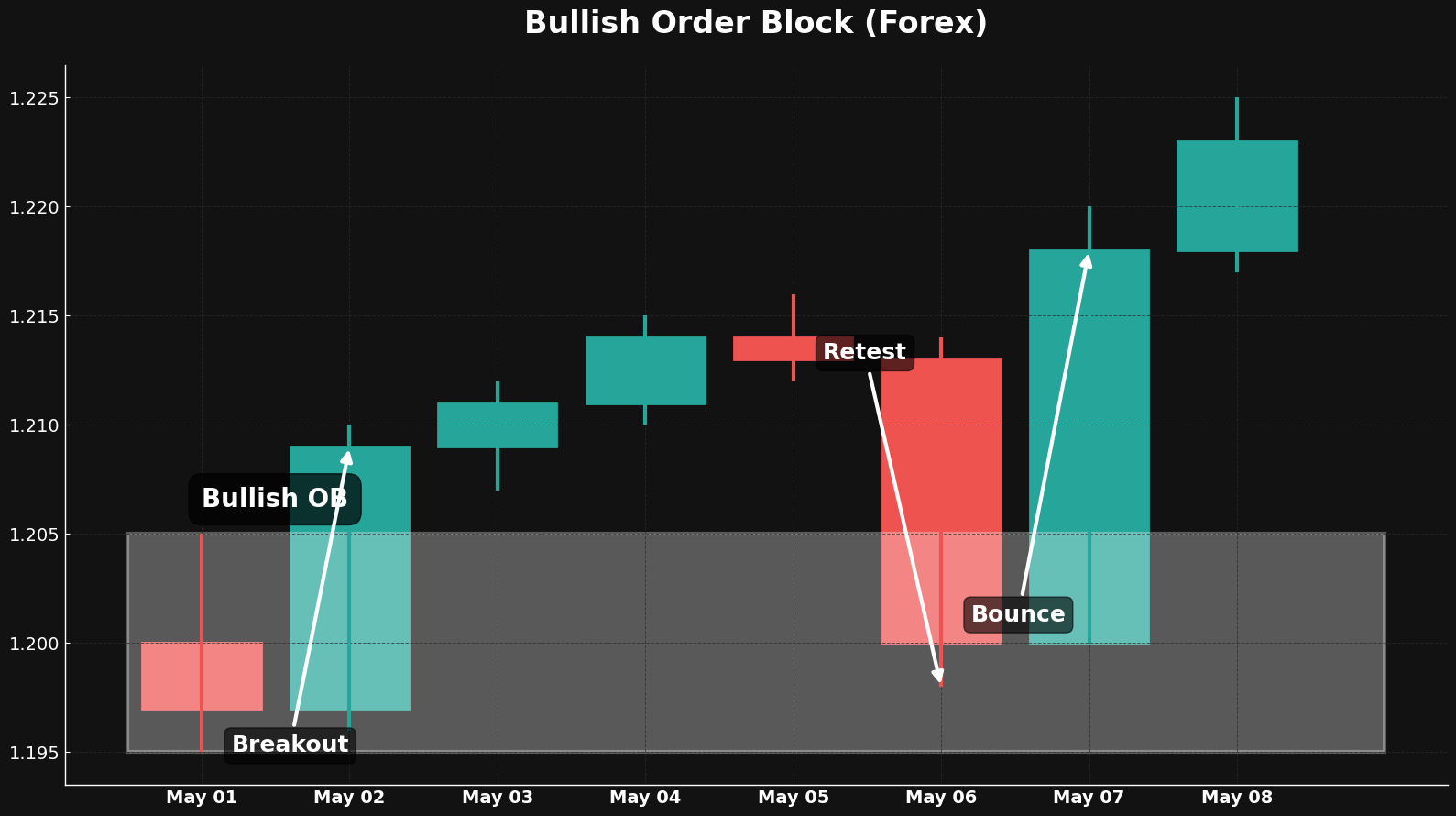

Order Blocks

Order blocks are zones where significant buying or selling occurred before a strong move in the opposite direction. These areas often act as magnets for price later, as institutions return to fill more orders.

Key Characteristics:

- Typically the last opposing candle before a strong move

- Often has high relative volume

- Price tends to return to these zones for retests

- Bullish order blocks form support; bearish order blocks form resistance

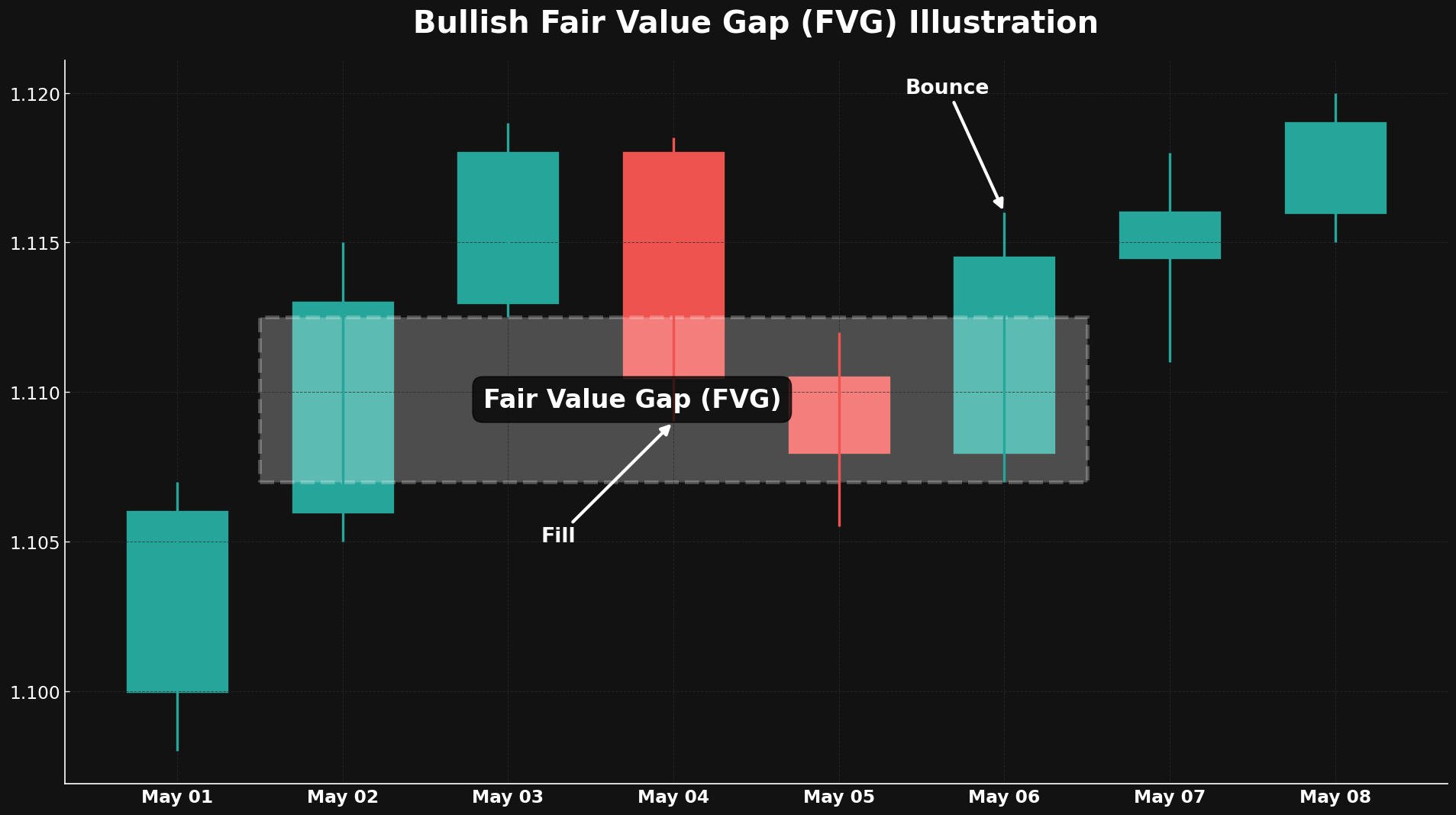

Fair Value Gaps (FVGs)

Fair Value Gaps represent imbalances in the market where price moves so rapidly that it creates a void or "gap" in fair value. These gaps tend to be filled as the market seeks equilibrium.

Key Characteristics:

- Formed when a candle's low is higher than the previous candle's high (bullish FVG) or vice versa

- Represents areas where liquidity is thin

- Often targeted by price in future moves

- The larger the gap, the stronger the imbalance

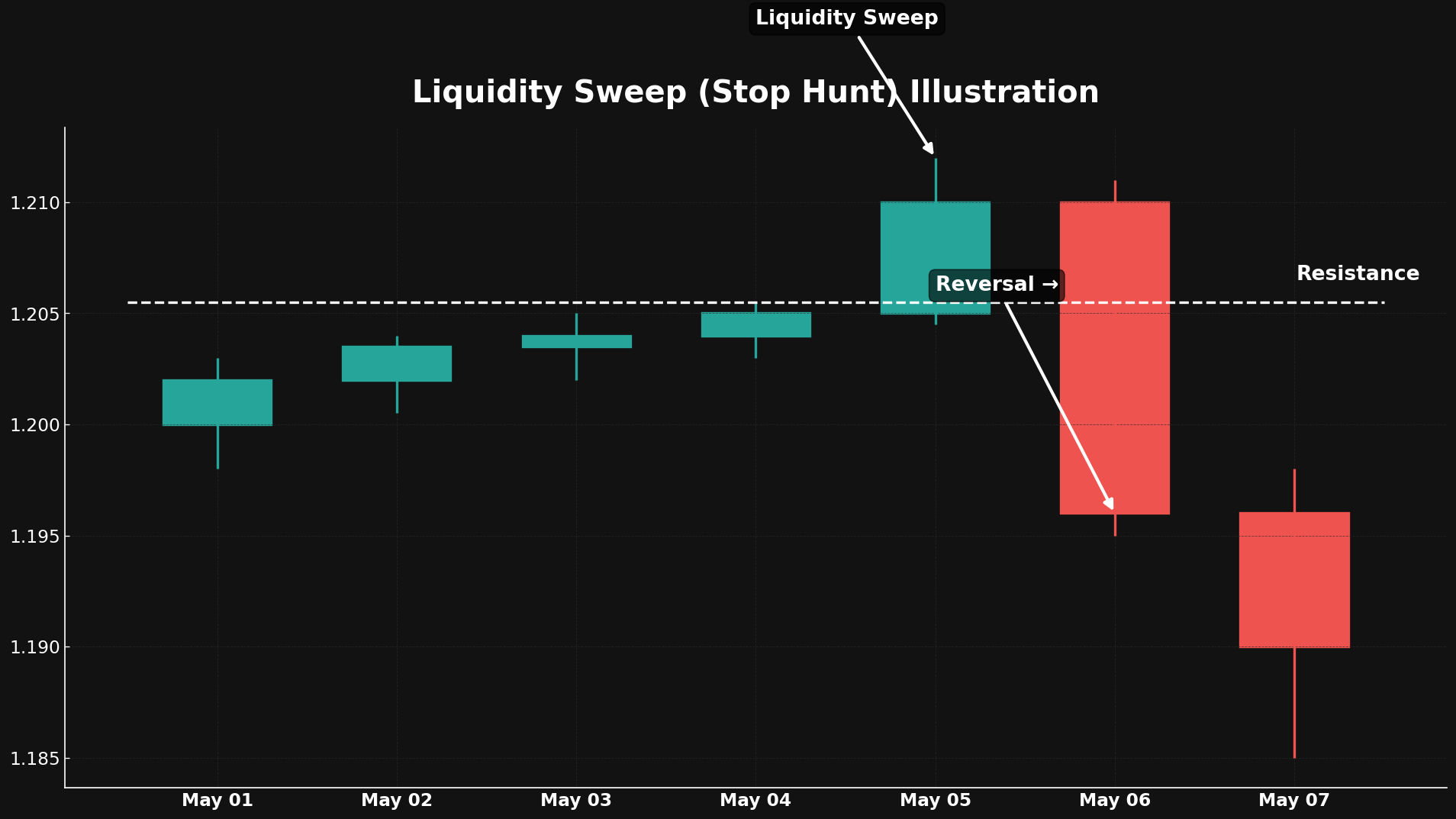

Liquidity Sweeps

Liquidity sweeps (also called stop hunts) occur when price briefly moves beyond a significant level to trigger stop losses or conditional orders before reversing. These movements are often engineered by institutional traders to find liquidity for their larger positions.

Key Characteristics:

- Price moves beyond obvious support/resistance levels

- Quick reversal follows the sweep

- Often occurs at swing highs/lows where stops accumulate

- May feature higher volume during the sweep

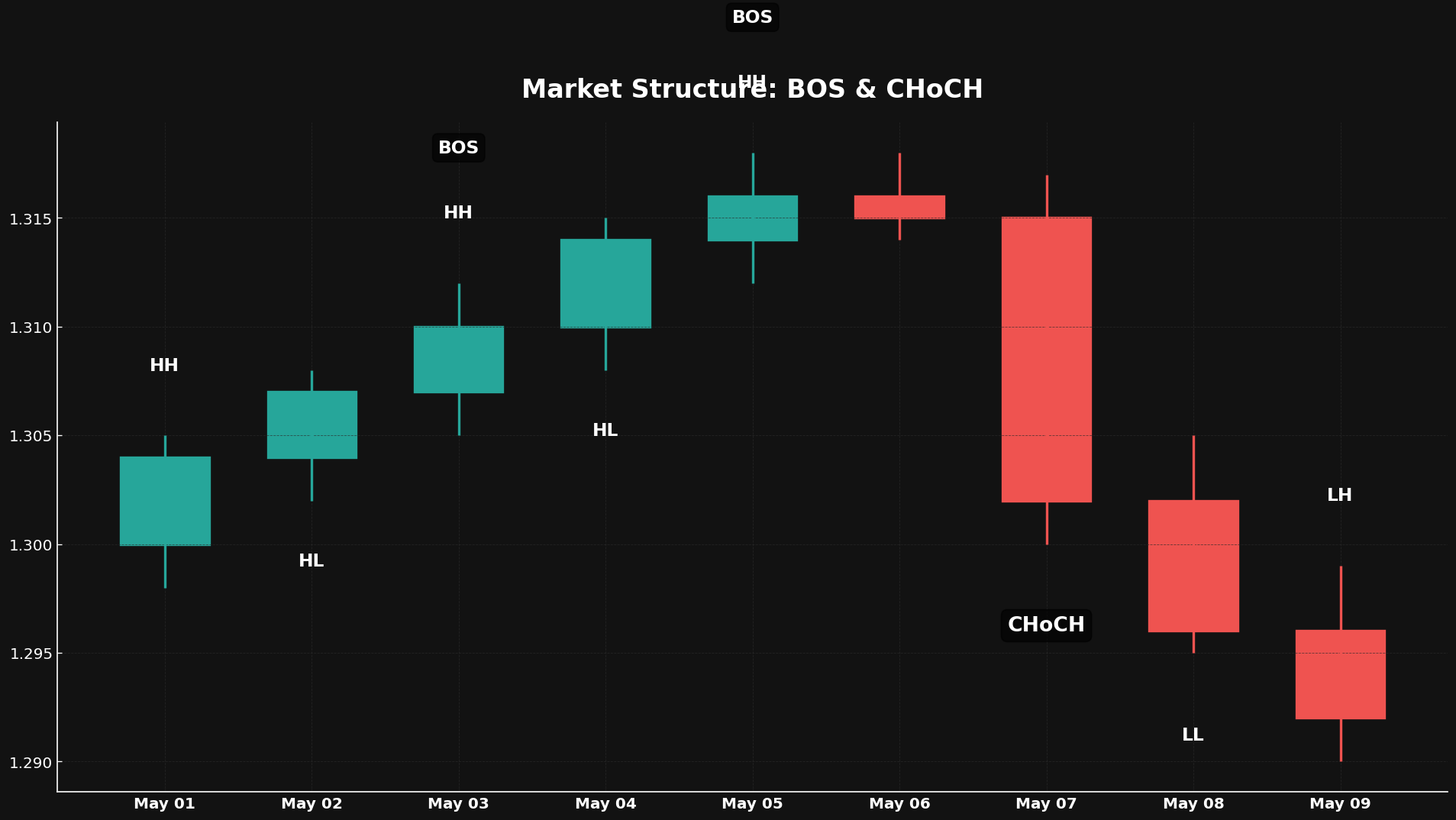

Market Structure

Market structure refers to the arrangement of highs and lows that define the trend. SMC traders pay close attention to breaks of structure (BOS) and changes in character (CHoCH), which signal potential trend shifts.

Key Concepts:

- Break of Structure (BOS): When price breaks a significant high/low

- Change of Character (CHoCH): When price confirms a structure break with a higher high/lower low

- Swing Failure Pattern (SFP): Failed attempt to make a new high/low

- Internal Structure: Minor highs/lows within larger structure

AI Advantages for SMC Trading

NervaTrade's AI-powered approach offers several significant advantages for SMC traders:

Pattern Recognition

Our AI can simultaneously analyze multiple timeframes to identify complex SMC patterns that might be missed by the human eye.

Emotion-Free Execution

The AI executes trades based solely on the predefined SMC criteria without the hesitation, doubt, or FOMO that affects human traders.

24/7 Market Monitoring

Unlike humans, our AI never sleeps, allowing it to monitor markets around the clock for perfect SMC setups across multiple instruments.

Contextual Analysis

NervaTrade's AI considers the broader market context, including multi-timeframe analysis, to validate SMC patterns before execution.

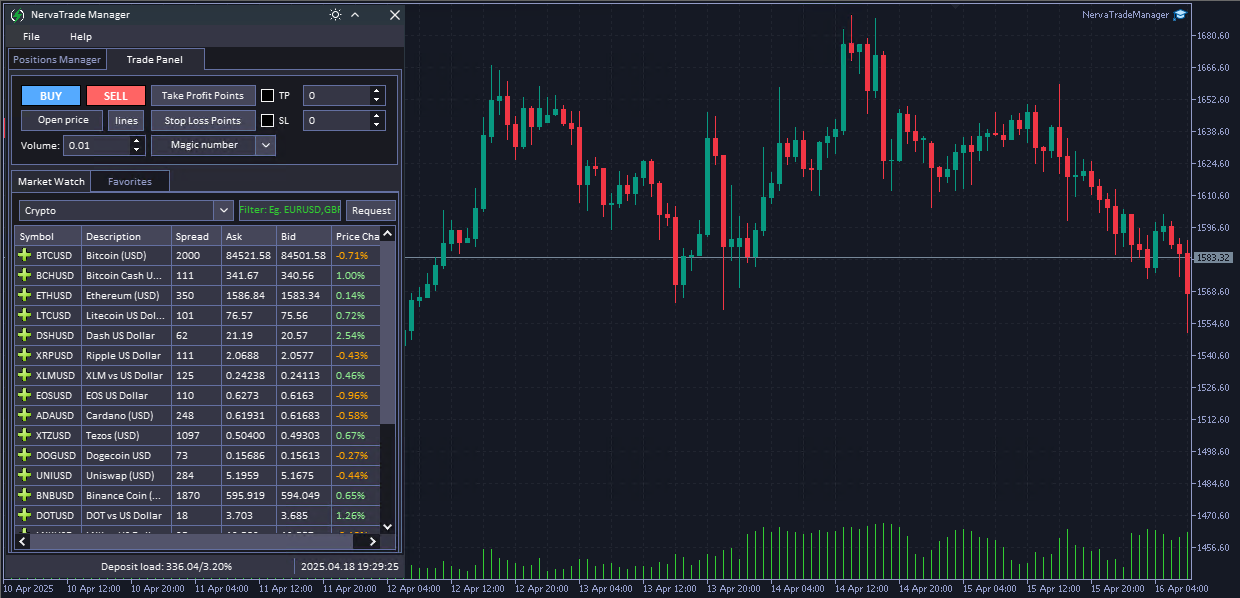

The Power of Visual Processing

What truly sets NervaTrade apart is our AI's ability to "see" charts like a human trader. Rather than relying solely on numerical data, our Neural Enhanced Real-time Vision Analytics (N.E.R.V.A.) system can:

- Interpret visual patterns from actual chart screenshots

- Process multiple timeframes simultaneously

- Identify complex SMC formations that don't fit neat mathematical definitions

- Learn and improve from new market conditions

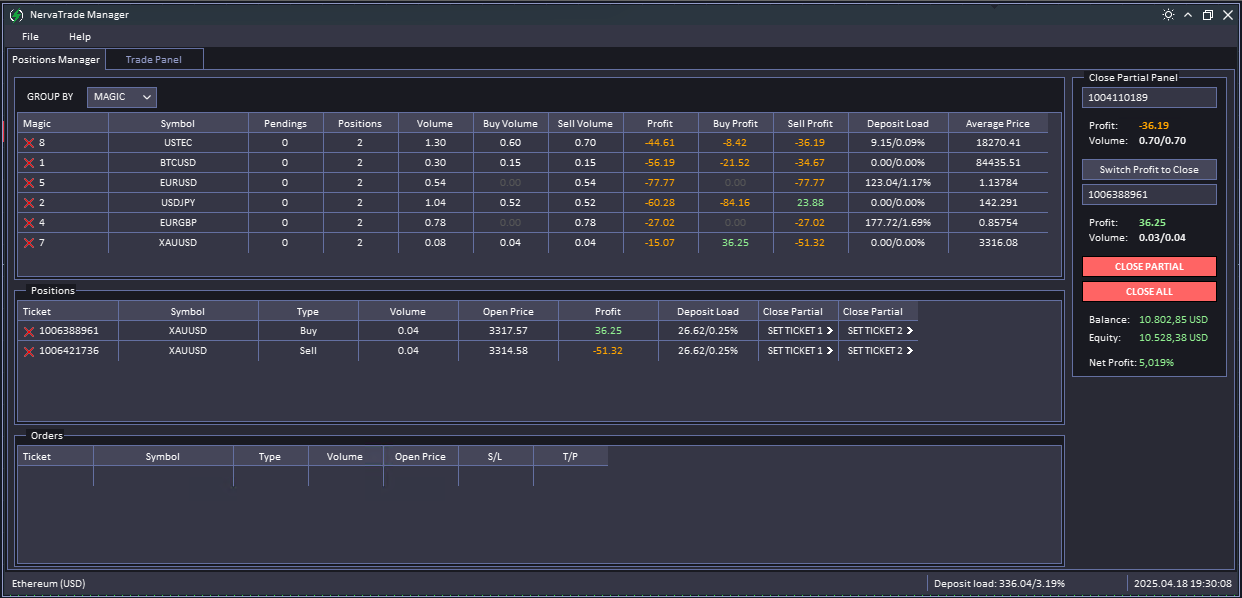

Implementation with NervaTrade

Implementing SMC strategies with NervaTrade is remarkably straightforward:

- Create a Prompt Model

Define your SMC strategy using our simple XML format. Focus on the patterns you want to identify (order blocks, FVGs, liquidity sweeps) and the conditions for entry and exit.

- Connect the Expert Advisor

Install our NervaTradeAI Expert Advisor in MetaTrader 5, enter your API key, and paste your Prompt Model ID.

- Set Risk Parameters

Configure position sizing, stop-loss, and take-profit settings based on your risk tolerance.

- Let the AI Work

The system will now automatically identify SMC patterns across your selected timeframes and execute trades according to your defined strategy.

What makes this approach revolutionary is that you don't need to code complex algorithms to detect order blocks or fair value gaps. Instead, you simply describe these patterns in natural language within your prompt model, and our AI handles the rest.

Example SMC Strategy

Here's an example of a Smart Money Concept strategy implemented as a NervaTrade prompt model:

<strategy>

<general_instructions>

• Time-frame: M15 execution, H1-H4 context

• SMC focus: Order Blocks, Breaker Blocks, Fair Value Gaps

• Chart-cleanliness rule → output "NEUTRAL" if price is ranging

• AI returns LONG / SHORT / NEUTRAL on each new M15 candle

</general_instructions>

<buy_conditions>

1. Order Block → Valid bullish OB with rejection from support

2. Fair Value Gap → Unfilled bullish FVG with price approaching

3. Liquidity Sweep → Evidence of stop hunt below significant low followed by reversal

4. BOS/CHoCH → Valid bullish Break of Structure or Change of Character

5. Multi-timeframe → H1 and H4 aligned in bullish direction or at support levels

</buy_conditions>

<sell_conditions>

1. Order Block → Valid bearish OB with rejection from resistance

2. Fair Value Gap → Unfilled bearish FVG with price approaching

3. Liquidity Sweep → Evidence of stop hunt above significant high followed by reversal

4. BOS/CHoCH → Valid bearish Break of Structure or Change of Character

5. Multi-timeframe → H1 and H4 aligned in bearish direction or at resistance levels

</sell_conditions>

<data_sources>

@{@SYMBOL,OHLC[M15,300]}

@{@SYMBOL,OHLC[H1,200]}

@{@SYMBOL,OHLC[H4,150]}

@SCREENSHOT[@SYMBOL,M15,TEMPLATE(SMC_PRO.tpl)]

@SCREENSHOT[@SYMBOL,H1,TEMPLATE(SMC_PRO.tpl)]

@SCREENSHOT[@SYMBOL,H4,TEMPLATE(SMC_PRO.tpl)]

</data_sources>

</strategy>This strategy focuses on identifying key SMC patterns across multiple timeframes. The AI will analyze both price data and visual chart patterns to identify valid setups according to the specified criteria.

Conclusion

Smart Money Concept trading represents one of the most sophisticated approaches to market analysis, focusing on institutional order flow rather than lagging indicators. With NervaTrade's AI-powered solution, this advanced methodology becomes accessible to traders of all experience levels.

By leveraging our Neural Enhanced Real-time Vision Analytics system, you can automate the identification and execution of SMC strategies without complex coding or constant screen time. The system's ability to process visual patterns, multi-timeframe data, and market context creates a powerful trading advantage that was previously available only to the most experienced traders.

Key Takeaway:

NervaTrade transforms Smart Money Concept trading from a complex, time-intensive approach into an automated, systematic strategy—allowing you to trade like an institution even with limited time, coding knowledge, or market experience.

Ready to Trade Like an Institution?

Start using NervaTrade to automate your Smart Money Concept trading today. No coding required—just describe your strategy and let our AI do the rest.